During a significant development in Ghana’s banking sector, Dr. Papa Kwesi Nduom, a prominent businessman and politician, had his banking license revoked by the Bank of Ghana (BoG).

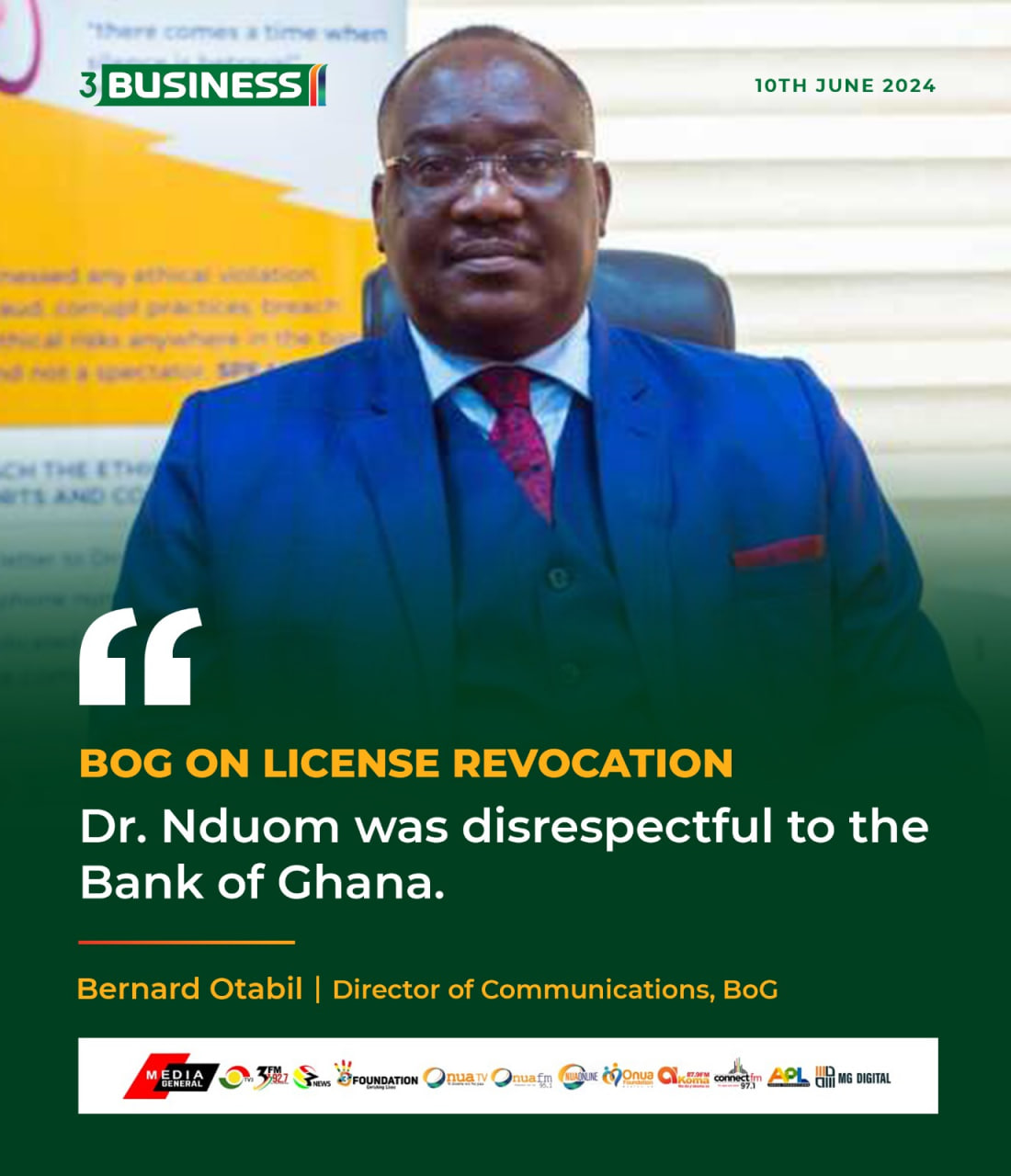

Bernard Otabil, the Communications Director for BoG, elaborated on the reasons behind this decision, highlighting Dr. Nduom’s disrespectful conduct towards the regulatory body as a key factor.

Background to the issue

Dr. Papa Kwesi Nduom was the founder and chairman of Groupe Nduom, which owns GN Bank and has been a significant figure in Ghana’s business landscape.

During his reign GN Bank under his leadership, expanded rapidly, aiming to provide banking services to underserved communities across the country(Ghana).

However, the bank’s operations came under scrutiny, leading to a dramatic intervention by the Bank of Ghana.

— Bernard Otabil, BoG Communications Director explains

The Revocation of GN Bank’s License

The Bank of Ghana revoked the banking licenses of several financial institutions as part of a broader effort to clean up the sector.

The BoG cited reasons such as insolvency, poor corporate governance, and non-compliance with banking regulations for these actions. Among the institutions affected was GN Bank, which had transitioned to a savings and loans company before its license was ultimately revoked.

Disrespect and Non-Compliance

In a detailed explanation, Bernard Otabil, BoG’s Communications Director, pointed out that Dr. Nduom’s conduct played a critical role in the decision.

According to Otabil, Dr. Nduom’s interactions with the Bank of Ghana were marked by a lack of respect and disregard for the regulatory framework.

“Dr. Papa Kwesi Nduom showed a pattern of disrespect towards the Bank of Ghana. His actions and statements undermined the authority and integrity of the regulatory body, which is unacceptable for any institution under our supervision,” Otabil stated.

This lack of cooperation and respect reportedly exacerbated the existing issues within GN Bank, making it difficult for the BoG to engage constructively with its management.

The revocation of GN Bank’s license has far-reaching implications, not only for Dr. Nduom and his employees and those who live under his business

It underscores the importance of regulatory compliance and the need for respectful and professional interactions between financial institutions and their regulators.

The BoG’s decision serves as a stern reminder that regulatory bodies play a crucial role in maintaining stability and confidence in the financial system. Disrespect and non-compliance, regardless of an institution’s size or the prominence of its leadership, will not be tolerated.

Response from Dr. Nduom

Dr. Nduom has consistently defended his actions and the operations of GN Bank. He has argued that the bank was unfairly targeted and that his efforts to comply with regulatory requirements were genuine.

In various statements, he has called for a fair review of the BoG’s decision, emphasizing his commitment to the financial well-being of his clients and the broader community.

The situation surrounding Dr. Nduom and GN Bank is a crucial challenges and complexities of regulating the financial sector.

It also emphasizes the necessity for mutual respect and adherence to regulatory standards to ensure the sector’s stability and integrity.

For more details on the BoG’s regulatory actions and the specifics of GN Bank’s license revocation, visit the official Bank of Ghana website. To read more about Dr. Nduom’s perspective and ongoing developments, you can follow updates on the Groupe Nduom official site.

Source TV3

K Fosu The Informant is a lifestyle blogger with 6 years' experience in content and web development. He is a Google keyword planner, SEO analyst, an influencer and entrepreneur who holds BA Degree from Ghana's Premier University.